Calypso

The Calypso Core Architecture refers to the foundational structure and design principles of the Calypso software platform, which is widely used in the financial industry for managing trading, risk management, and processing of financial instruments. Calypso is known for its comprehensive suite of capabilities covering front-to-back office operations in capital markets.

Calypso Core Architecture

Here are some key aspects of the Calypso Core Architecture:

-

Service-Oriented Architecture (SOA): Calypso is built on a service-oriented architecture, where various functionalities are encapsulated into independent services. These services communicate with each other via well-defined interfaces, promoting modularity, scalability, and reusability of components.

-

Modularity and Extensibility: follows a modular design approach, allowing users to configure and extend the platform based on specific business requirements. New features and functionalities can be added through plug-ins or extensions without modifying the core system.

-

Integration Framework: provides a robust integration framework for connecting with external systems and data sources. This includes support for standard protocols like FIX (Financial Information eXchange) for trading connectivity and APIs for data import/export.

-

Data Model: The Calypso Core Architecture includes a sophisticated data model that represents various financial instruments, transactions, positions, and risk factors. This data model is highly customizable and supports complex financial products and derivatives.

-

Workflow Management: incorporates workflow management capabilities to automate and streamline business processes across different stages of trade lifecycle. This includes trade capture, confirmation, settlement, and reconciliation workflows.

-

Scalability and Performance: The architecture of Calypso is designed to handle large volumes of transactions and data efficiently. It supports distributed deployment models and can scale horizontally by adding more servers or nodes to the infrastructure.

-

Security and Compliance: emphasizes security and compliance with regulatory standards in the financial industry. The architecture includes features such as role-based access control, audit trails, and data encryption to ensure data confidentiality and integrity.

-

User Interface: provides a modern and intuitive user interface (UI) that is customizable based on user roles and preferences. The UI is designed to facilitate efficient navigation and decision-making for traders, risk managers, and other financial professionals.

In summary, the Calypso Core Architecture is characterized by its modular, scalable, and extensible design, which enables financial institutions to manage complex trading and risk management processes effectively while adhering to industry standards and regulatory requirements.

Calypso Engine Framework

The Calypso Engine Framework is a fundamental component of the software platform, specifically focusing on the processing and management of financial transactions, risk analytics, and related operations within capital markets. This framework forms the core engine responsible for executing trades, valuing positions, calculating risk metrics, and supporting various financial instruments and products.

Key aspects and features of the Engine Framework include:

-

Financial Instrument Support: The framework provides extensive support for a wide range of financial instruments, including equities, fixed income securities, derivatives (such as options, futures, and swaps), foreign exchange (FX) instruments, commodities, and structured products. It can handle complex instrument structures and pricing models.

-

Trade Lifecycle Management: The Calypso Engine manages the entire trade lifecycle, from trade capture and validation to confirmation, settlement, and post-trade processing. It supports real-time processing of trades and events, ensuring accurate and timely updates to positions and risk exposures.

-

Risk Management and Analytics: One of the core capabilities of the Calypso Engine is risk management. It performs sophisticated risk calculations and scenario analysis based on market data, positions, and portfolios. Risk metrics such as value-at-risk (VaR), stress testing, and sensitivity analysis are computed to assess exposure levels.

-

Calculation Engine: The framework includes a powerful calculation engine that supports complex mathematical computations required for pricing financial instruments and measuring risk. This engine is designed for high performance and scalability to handle large volumes of calculations in real-time.

-

Event Processing and Workflow: The Calypso Engine processes events and triggers workflows based on predefined rules and conditions. This includes handling trade events, market data updates, regulatory changes, and user-defined actions. Workflow automation streamlines operational tasks and improves efficiency.

-

Integration Capabilities: The framework integrates seamlessly with external systems, market data providers, trading platforms, and clearing houses through standardized protocols and APIs. This ensures interoperability and data consistency across multiple systems and parties.

-

Customization and Extension: The Calypso Engine supports customization and extension through configuration parameters, scripting languages, and plug-in modules. Users can define custom workflows, pricing models, risk rules, and reporting formats tailored to their specific business needs.

-

Performance Optimization: Performance optimization is a key aspect of the Calypso Engine Framework, leveraging parallel processing, caching mechanisms, and distributed computing techniques to achieve low-latency processing and high throughput.

Overall, the Calypso Engine Framework is designed to be a comprehensive and robust solution for financial institutions, enabling them to manage trading activities, risk exposures, and operational workflows efficiently while meeting regulatory requirements and market demands. Its flexibility, scalability, and analytical capabilities make it a preferred choice for front-to-back office operations in capital markets.

Calypso Scheduler

The Scheduler is a component within the software platform that handles the scheduling and automation of various tasks and processes related to trade processing, data management, reporting, and system maintenance. The scheduler plays a crucial role in optimizing operational efficiency, ensuring timely execution of critical activities, and enabling effective resource utilization within the Calypso environment.

Key features and functionalities of the Scheduler include:

-

Task Scheduling: The scheduler allows users to define and schedule tasks to be executed at specific times or intervals. This includes routine processes such as data loading, batch jobs, trade settlement, reconciliation, risk calculations, and report generation.

-

Automated Workflows: Tasks scheduled by the Calypso Scheduler can trigger automated workflows and processes across different modules within the Calypso platform. For example, the completion of a data loading task can initiate downstream processes like trade validation and position updates.

-

Event-Based Triggers: The scheduler supports event-based triggers, enabling tasks to be executed in response to specific events or conditions within the system. This flexibility allows for dynamic task execution based on real-time data changes or user-defined events.

-

Dependency Management: Complex task dependencies and relationships can be managed using the Calypso Scheduler. Tasks can be sequenced based on dependencies, ensuring that prerequisite tasks are completed before dependent tasks are executed.

-

Resource Allocation: The scheduler optimizes resource allocation by coordinating the execution of tasks across distributed environments. It manages workload distribution to minimize system bottlenecks and maximize resource utilization.

-

Monitoring and Logging: Comprehensive monitoring and logging capabilities are integrated into the scheduler, providing visibility into task execution, status updates, and performance metrics. Administrators can track task progress, identify failures, and troubleshoot issues efficiently.

-

Alerts and Notifications: The scheduler can send alerts and notifications to users or administrators based on task completion status, errors, or exceptional conditions. This proactive approach enables timely intervention and resolution of operational issues.

-

Configuration and Management: Users can configure and manage scheduled tasks through a user-friendly interface or configuration files. Task schedules can be adjusted dynamically to accommodate changing business requirements or operational priorities.

In summary, the Calypso Scheduler is a vital component of the Calypso platform, facilitating task automation, workflow orchestration, and resource management across complex financial operations. By centralizing and automating routine processes, the scheduler enhances operational efficiency, reduces manual effort, and ensures consistent and reliable performance within the Calypso ecosystem.

Calypso Risk Infrastructure

The Calypso Risk Infrastructure refers to the comprehensive framework and capabilities within the Calypso software platform dedicated to managing and analyzing risk across financial instruments, portfolios, and trading activities. Risk management is a critical aspect of financial markets, and Calypso’s risk infrastructure provides sophisticated tools and methodologies to quantify, monitor, and mitigate various types of risk exposures.

Key components and features of the Calypso Risk Infrastructure include:

-

Risk Measurement and Analytics: Calypso supports a wide range of risk measurement techniques, including value-at-risk (VaR), stress testing, scenario analysis, sensitivity analysis, and Monte Carlo simulations. These analytics provide insights into market, credit, liquidity, and operational risks associated with trading activities.

-

Risk Aggregation: The risk infrastructure aggregates risk exposures at different levels of granularity, including individual trades, portfolios, business units, and the entire enterprise. This enables holistic risk assessment and reporting across the organization.

-

Multi-Asset Class Coverage: Calypso’s risk infrastructure covers a diverse range of asset classes, including equities, fixed income securities, derivatives, foreign exchange (FX), commodities, and structured products. It supports complex instrument structures and pricing models inherent in these asset classes.

-

Real-Time Risk Monitoring: The infrastructure provides real-time risk monitoring capabilities, allowing traders, risk managers, and executives to track risk exposures and limit breaches as they occur. Alerts and notifications can be triggered based on predefined risk thresholds.

-

Integration with Trading and Operations: Risk calculations are seamlessly integrated with trading and operations workflows within Calypso. Realized and potential risk impacts are factored into decision-making processes, ensuring that risk considerations are embedded in trading strategies and operational activities.

-

Regulatory Compliance: Calypso’s risk infrastructure supports regulatory compliance by providing risk metrics and reports required by regulatory authorities (e.g., Basel III, MiFID II, Dodd-Frank). It helps financial institutions demonstrate adherence to risk management guidelines and standards.

-

Risk Limits and Controls: The infrastructure enables the definition and enforcement of risk limits and controls across different dimensions (e.g., exposure limits, concentration limits, counterparty limits). Breaches of risk limits trigger automated actions or alerts to mitigate excessive risk exposure.

-

Historical Analysis and Reporting: Historical risk data can be analyzed and visualized through customizable reports and dashboards within Calypso. This facilitates trend analysis, performance attribution, and retrospective risk assessment for decision support and regulatory reporting purposes.

Overall, the Calypso Risk Infrastructure empowers financial institutions to proactively manage risk, optimize capital allocation, and enhance decision-making in dynamic and complex trading environments. By leveraging advanced analytics and integrating risk management with front-to-back office processes, Calypso enables organizations to achieve a comprehensive and proactive approach to risk management in capital markets.

Calypso Trading System (Financial Markets)

If you meant Calypso in finance, it’s a capital markets trading and risk management platform used by banks and hedge funds. Here’s what it does:

Key Features

✅ Multi-Asset Trading (FX, Equities, Fixed Income, Derivatives)

✅ Risk Management (Real-time exposure monitoring)

✅ Post-Trade Processing (Settlement, clearing, reconciliation)

✅ Algorithmic Trading Support

Who Uses It?

-

Investment banks (e.g., JPMorgan, Citi)

-

Asset managers

-

Hedge funds

Competitors

-

Bloomberg Terminal

-

Murex

-

Broadridge

Here’s a detailed breakdown of the Calypso Trading System, the leading cross-asset trading and risk management platform used by financial institutions worldwide:

Calypso Trading System – Key Components & Architecture

1. Core Modules & Menu Structure

A. Trading Dashboard

-

Order Management System (OMS)

-

Order entry/modification/cancellation

-

Aggregated market data views

-

Algorithmic trading strategies

-

-

Execution Management System (EMS)

-

Smart order routing

-

Dark pool access

-

Transaction cost analysis

-

B. Risk Management Console

-

Pre-Trade Risk

-

Credit limits monitoring

-

Value-at-Risk (VaR) calculations

-

Position limits

-

-

Real-Time Monitoring

-

P&L dashboards

-

Margin requirements

-

Stress testing scenarios

-

C. Post-Trade Processing

-

Clearing & Settlement

-

Automated matching

-

FIX protocol integration

-

Settlement instructions

-

-

Collateral Management

-

Margin calls processing

-

Haircut calculations

-

Triparty repo support

-

2. Technical Specifications

| Feature | Details |

|---|---|

| Supported Assets | Equities, FI, FX, Commodities, Derivatives |

| Latency | <10ms for order execution |

| APIs | FIX 4.2/4.4, REST, Java/Python SDKs |

| Cloud Deployment | AWS, Azure, Google Cloud |

| Regulatory Compliance | MiFID II, EMIR, Dodd-Frank, Basel III |

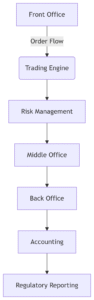

3. Workflow Example (FX Swap Trade)

-

Trade Capture: Trader enters deal in front-end

-

Risk Check: System validates against credit limits

-

Confirmation: Auto-generated SWIFT MT300

-

Settlement: Instructions sent to CLS/DTCC

-

Accounting: Entries posted to general ledger

-

Reporting: EMIR/CFTC filings generated

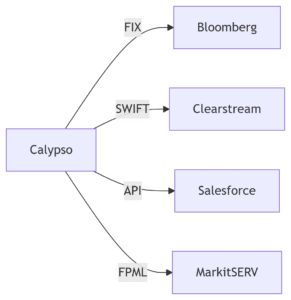

4. Integration Ecosystem

FIX

SWIFT

API

FPML

Calypso

Bloomberg

Clearstream

Salesforce

MarkitSERV

5. Competitive Advantages

-

Unified Platform: Eliminates silos between front/middle/back office

-

Real-Time P&L: Updates every 50ms

-

Customizable Workflows: Drag-and-drop rule builder

-

AI Features: Predictive margin optimization

6. System Requirements

-

Minimum Deployment: 8-core server, 32GB RAM, SSD storage

-

Database: Oracle 19c or SQL Server 2019

-

OS: Linux RHEL or Windows Server 2016+

For implementation guides or specific module details (e.g., how to configure credit limits), let me know which area you’d like to explore deeper. Most installations require Calypso-certified consultants due to system complexity.

Leave a Reply